YES BANK ACE Credit Card: Your Key to Spend Wise and Win

- 2 Feb 26

- 8 mins

YES BANK ACE Credit Card: Your Key to Spend Wise and Win

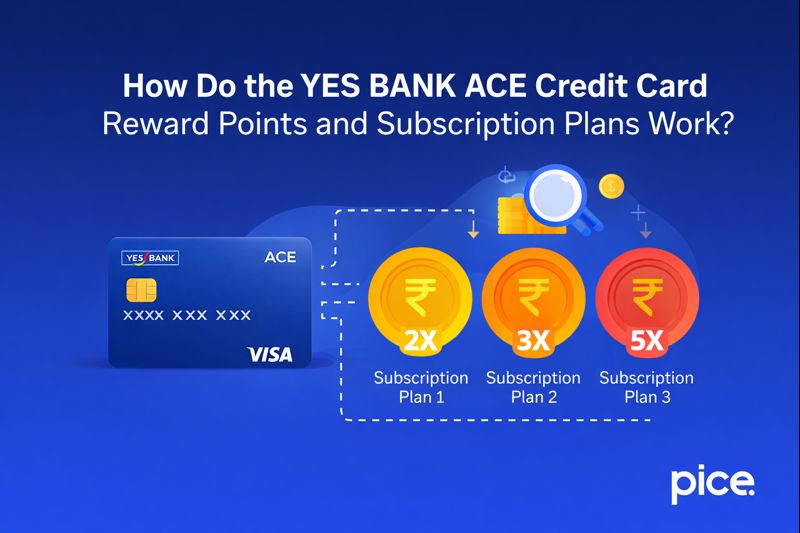

- How Do the YES BANK ACE Credit Card Reward Points and Subscription Plans Work?

- Things to Keep in Mind About the YES BANK ACE Credit Card Rewards Program

- Additional YES BANK ACE Credit Card Benefits

- How To Find and Link Eligible Merchants for the YES BANK ACE Credit Card?

- How to Redeem YES Rewardz Points?

- Exclusive YES BANK ACE Credit Card Offers

- What is the YES BANK ACE Credit Card Eligibility Criteria?

- What is the YES BANK ACE credit card Application Process?

- 5 Insider Hacks to Get Up to 10X EDGE REWARDS Points

- Conclusion

Key Takeaways

- The YES BANK ACE credit card offers up to 5X YES Rewardz Points via subscription plans.

- Groceries, dining, travel, and online spends deliver the highest reward value.

- Subscription plans help customise rewards based on spending behaviour.

- Lifestyle perks like BOGO coffee and purchase protection add extra value.

- Smart tracking and timely payments maximise gains on the YES BANK ACE credit card.

Ready to turn every swipe into rewards? Then, go for the YES BANK ACE credit card to ace your credit card game! The biggest flex of this card lies in its tiered reward structure. You can earn up to 5X YES Rewardz Points on basic transactions like grocery shopping.

From lifestyle privileges like BOGO coffee offer at participating outlets to insurance coverage on your digitally-bought electronics, the ACE card covers you comprehensively. Continue reading to explore the card’s features, charges, and smart hacks to make the most of every reward.

How Do the YES BANK ACE Credit Card Reward Points and Subscription Plans Work?

You can customise your rewards on the YES BANK ACE Credit Card with standard earnings or high-yield plans offering up to 5X Reward Points. Here’s how you can do it:

- Base YES Rewardz:

- Online Spends (except selected categories): 8 YES Rewardz Points per ₹200

- Offline Spends (except selected categories): 4 YES Rewardz Points per ₹200

- Selected Spends: 2 YES Rewardz Points per ₹200.

Note: Eligible selected spends are utility, insurance and education-related payments.

- Accelerated YES Rewardz:

- Subscription Plan 1: ₹1000/year

- Online Spends: 2 times the base reward points

- Offline Spends: 3 times the base reward points

- Select Spends: 3 times the base reward points.

- Subscription Plan 2: ₹2000/year

- Online Spends: 3 times the base reward points

- Offline Spends: 5 times the base reward points

- Subscription Plan 1: ₹1000/year

Note: Subscription plan 1 applies to all categories except exclusions, while subscription plan 2 includes only healthcare, fashion, travel and dining spends.

Things to Keep in Mind About the YES BANK ACE Credit Card Rewards Program

- Transactions like rent, wallet top-up, fuel, government-related payments, cash withdrawals and EMI conversions are not eligible for YES Rewardz.

- YES BANK ACE cardholders can earn a maximum of 5000 YES Rewardz per month.

- YES Rewardz on utility expenses are limited to 150 per statement cycle.

- Accelerated YES Rewardz via subscription plans are capped at 75000 per calendar month.

- Up to a maximum of 100,000 YES Rewardz (70% of the invoice value) can be redeemed in a calendar month.

Additional YES BANK ACE Credit Card Benefits

- Fuel Surcharge Waiver

Enjoy a 1% fuel surcharge waiver on fuel transactions ranging between ₹400 and ₹5000 at petrol pumps across India. With savings capped at ₹100 per month, this benefit helps reduce recurring fuel costs, making daily commutes more economical for regular drivers.

- Purchase Protection Insurance

The YES BANK ACE Credit Card offers purchase protection insurance up to ₹50,000 on digitally purchased mobiles and electronics. The coverage remains valid for 6 months from the date of purchase. It safeguards you against accidental damage or theft on eligible transactions.

- BOGO Coffee

Indulge in coffee breaks with the Buy One Get One (BOGO) coffee offer at participating outlets inside select malls across India. Pay for one cup and enjoy another free, whether it is a cappuccino, latte, or Americano.

- Lifestyle Benefit

Cardholders can enjoy curated lifestyle privileges across travel, dining, shopping, and wellness, thanks to YES BANK’s merchant partnerships. These exclusive deals are accessible through the YES Rewardz platform. It allows users to unlock premium experiences along with everyday savings in select cities.

How To Find and Link Eligible Merchants for the YES BANK ACE Credit Card?

To find eligible merchants on your YES BANK ACE credit card, follow the steps below:

- Visit yesbank.cardhq.com

- Enter your registered mobile number and verify it using OTP.

- Add your YES BANK credit card by entering the required details.

- Confirm card addition via OTP sent to your mobile.

- View the list of eligible merchants and active offers.

- Select preferred merchants and click ‘Continue’.

- Your card is securely linked to the selected merchant.

- Log in to the merchant’s app or website using the same mobile number to view offers.

How to Redeem YES Rewardz Points?

YES BANK provides a flexible and easy-to-use redemption ecosystem. You can redeem your accumulated YES Rewardz Points for:

- Flight bookings

- Hotel reservations

- Shopping vouchers

- Merchandise and lifestyle products

To redeem, simply log in to the YES Rewardz portal using your registered mobile number and YES BANK SELECT Credit Card credentials. Browse through the catalogue, choose your preferred option, and redeem instantly.

If you need assistance, you can contact YES BANK support at 1800 4190 600 or email support@yesrewardz.com.

Exclusive YES BANK ACE Credit Card Offers

YES BANK ACE cardholders can take advantage of certain additional discounts. Some of them are:

- Up to ₹500 off on Abhibus

- Flat 20% off on IGP

- Additional 15% discount at TaxBuddy

- Instant 10% additional discount on AJIO

Note: All above-mentioned deals except TaxBuddy are valid till 31st March, 2026. These offers are subject to change. Visit the YES Privileges for recent updates.

What is the YES BANK ACE Credit Card Eligibility Criteria?

Any Indian between 18 and 60 years with either a salary of ₹25,000 per month or ₹750,000 of annual income, if self-employed, can apply for the YES BANK ACE credit card. The applicant must submit the following documents:

- PAN Card or Form 60

- Proof of income - Latest payslip / Form 16 / IT return copy

- Residence proof - Passport / Ration Card/ Electricity bill / Landline telephone bill.

Note: This list is indicative, and the required documents may vary depending on the specific case.

What is the YES BANK ACE credit card Application Process?

- Visit the YES BANK official website and navigate to ‘Credit Cards’.

- Search for the YES BANK ACE credit card and click on ‘apply now’.

- Then, fill in personal, professional, and financial details.

- Upload the required documents to complete the KYC verification.

- Wait a few days to receive approval. Your card will be dispatched upon successful verification.

YES BANK ACE Credit Card Charges

| Fee Types | Charges |

| Joining fee | ₹599 (Waived if spent ₹10,000 within a month of card setup) |

| Renewal fee | ₹599 (waived if spent ₹100,000 within 12 months before card renewal) |

| Interest Rate | 3.99% monthly (47.88% yearly) on overdue amount 2.49% against a fixed deposit |

| Cash Advance Fee | 2.5% or ₹500 of the amount (whichever is higher) |

| Cheque Return or Cheque Dishonour Fee | ₹450 |

| Auto Debit Fee | 2% or ₹450 (whichever is higher) |

| Foreign currency transaction fee | 2.75% |

| Late Payment Fee | Less than ₹500: NIL ₹500 and above: ₹1350 or 10% of the amount |

5 Insider Hacks to Get Up to 10X EDGE REWARDS Points

- Activate the right subscription plan based on your spending category.

- Prioritise online spends for higher base rewards.

- Use the card for groceries, dining and travelling to unlock accelerated rewards.

- Combine merchant offers with reward redemption for maximum value.

- Track monthly caps to avoid wasted spending.

💡Even after optimising rewards, missing payment deadlines can wipe out gains. Link your YES BANK ACE Credit Card to the Pice app, your all-in-one credit card bill manager, to stay payment-ready in a single tap.

Conclusion

The YES BANK ACE credit card blends accelerated rewards, flexible subscriptions, and lifestyle perks into one smart package. With up to 5X rewards on daily spends, curated offers, and strong protections, it’s ideal for users who want everyday savings while maximising long-term value from every swipe.

By

By